data science courses with placement

SKF - DSC

-

-

(407 Reviews)

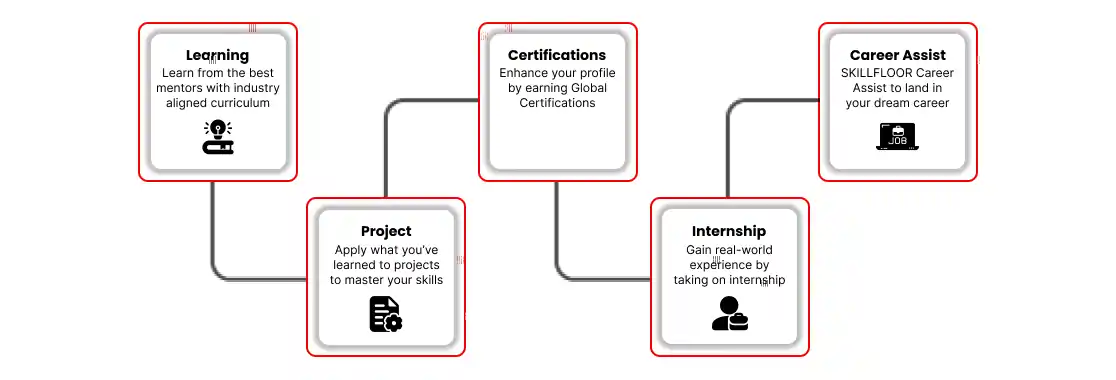

- Skills: Master skills such as Python programming, machine learning, data analysis, and statistical modelling in data science techniques to effectively communicate insights.

- Career: career opportunities in data science, machine learning engineering, business intelligence, and more. Access exclusive job placement assistance and career counselling sessions.

- Flexible Learning: Learn at your own pace with our flexible online learning platform. Engage with expert instructors and peers through interactive discussions and live Q&A sessions.