Business Finance Associate

SF-FA-BFIE-2311

-

-

(264 Reviews)

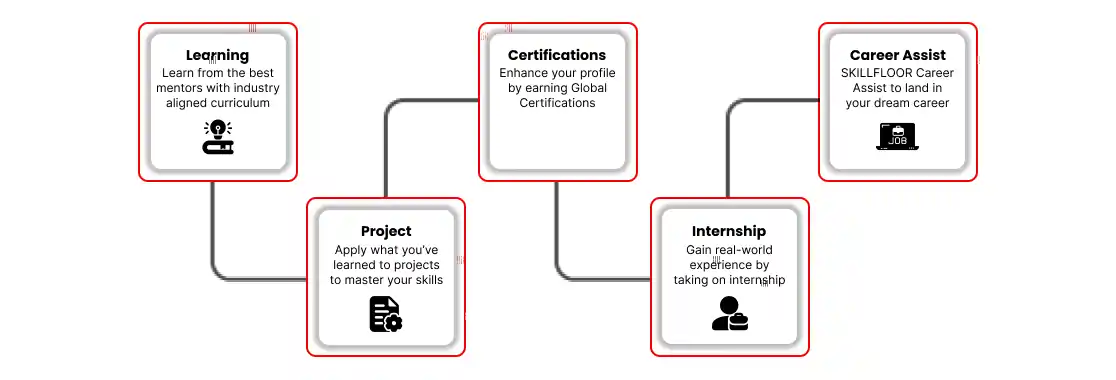

- Essential financial skills: Learn to analyze financial statements, manage budgets, and make informed investment decisions.

- Career opportunities: Gain expertise sought after by employers in finance, accounting, consulting, and more.

- Secure valuable internships: Build real-world experience through one-month internships with leading companies and financial institutions.