Finance And Accounting Associate

SF-FA-ACCE-2312

-

-

(461 Reviews)

- Accounting skills: Master fundamental concepts, principles, and practices essential for a successful career in accounting.

- Career opportunities: Open doors to a wide range of career paths including financial analyst, auditor, tax accountant, and more.

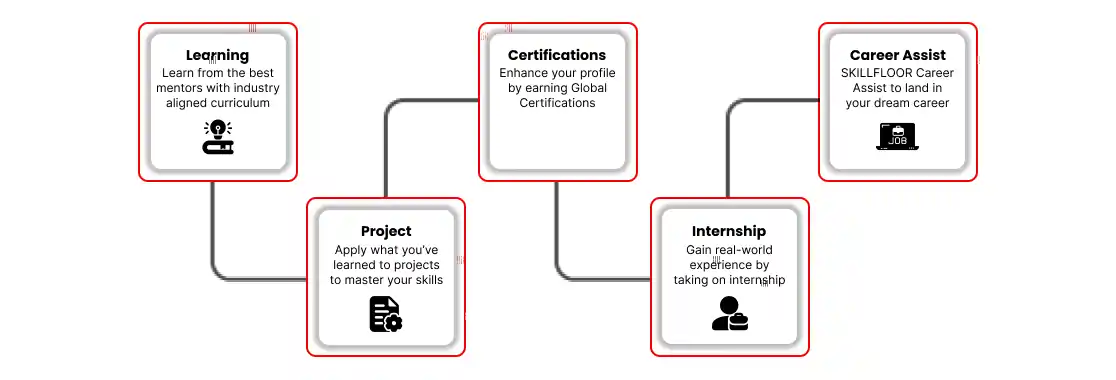

- Gain practical experience: Apply classroom knowledge in real-world settings through one-month internships with leading firms and organizations.